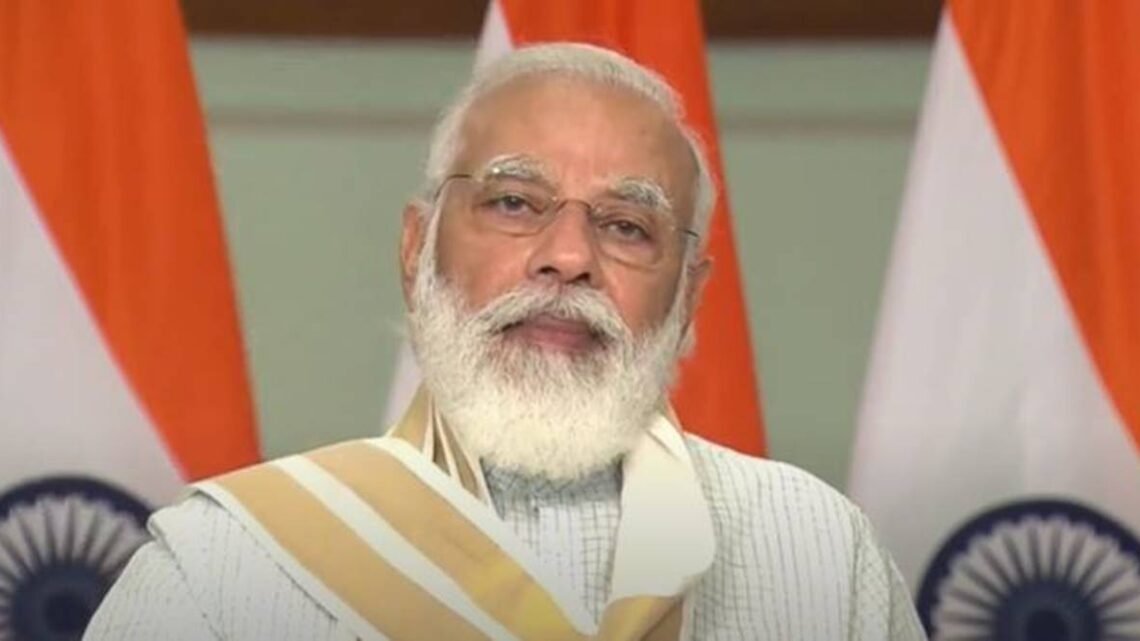

Faceless Assessment, Taxpayers’ Charter From Today, Says PM Modi

13th August 2020“Faceless assessment, taxpayers’ charter implemented from today as part of tax reforms,” PM Modi said in his remarks on unveiling the tax measure.

PM Narendra Modi launched “Transparent Taxation – Honoring The Honest” platform to reform the tax system.

Prime Minister Narendra Modi made a big new push for tax reforms by launching the “Transparent Taxation – Honoring The Honest” platform, in what he said will strengthen efforts of “reforming and simplifying our tax system”. The Prime Minister also unveiled Taxpayers Charter and faceless assessment, the next phase of direct tax reforms aimed at easing compliance and rewarding honest taxpayers as the government looks to rebuild the pandemic-hit economy.

Here are 10 things to know about the new tax reforms:

- Finance Minister Nirmala Sitharaman, while presenting the budget for 2020-21, had announced a ‘taxpayer charter’ to empower citizens by ensuring time-bound services by the Income Tax department.

- “The country’s honest taxpayer plays a big role in nation building… The new facilities being launched today reinforce the government’s commitment to honoring the honest,” PM Modi added.

- The newly launched platform will offer faceless assessments, faceless appeal and taxpayer charter. Faceless appeal will be applicable from September 25, while faceless assessment and taxpayer charter will come into force from the very day of launch i.e. August 13.

- “This (the platform for “Transparent Taxation Honoring the Honest” ) adds strength to our efforts of reforming and simplifying our tax system. It will benefit several honest tax payers, whose hard work powers national progress,” PM Modi had said in a tweet on Wednesday.

- Nirmala Sitharaman in a tweet said, “Truly, this shall mark an important step forward in providing a simple and transparent taxation regime for India”.

- “Wealth creators will be respected in this country,” Nirmala Sitharaman had said in her 2020-21 Budget speech. “We wish to enshrine in the statutes a ‘taxpayer charter’ through this Budget. Our government would like to reassure taxpayers that we remain committed to taking measures so that our citizens are free from harassment of any kind.”

- The government has undertaken various tax reforms during the last six years.

- The reforms include reduction in corporate tax last year to 22 per cent from 30 per cent for existing companies and 15 per cent for new manufacturing units, scraping of dividend distribution tax and faceless assessment.The I-T Department has also taken several tax-payer friendly measures over the years. It launched the Direct Tax ‘Vivad se Vishwas’ scheme to expedite the resolution of pending tax disputes.

- The income tax department has simplified compliance norms for startups and has moved forward with the pre-filling of income tax returns to make compliance more convenient for individual taxpayers.

- Currently, most of the functions of the Income Tax Department starting from the filing of the return, processing of returns, issuance of refunds, and assessment are performed in the electronic mode without any human interface.